Kenya has emerged as one of the world’s top borrowers of International Monetary Fund (IMF) loans, ranking seventh globally in outstanding credit. The country currently owes SDR 2.95 billion, roughly Ksh519.8 billion, to the Fund.

This growing reliance on external financing highlights the pressure on Kenya’s economy to meet budgetary needs and implement critical reforms. With Argentina, Ukraine, Ecuador, Egypt, Pakistan, and Côte d’Ivoire leading the list, Kenya’s position signals the urgent need for alternative funding strategies and stronger fiscal discipline.

Kenya’s IMF Loans Reveal Growing Dependence on External Financing

The latest IMF data shows Kenya’s debt profile continues to expand, placing it ahead of several major African economies. Only Egypt and Côte d’Ivoire have larger IMF obligations on the continent, while Angola, Ghana, Ethiopia, and Tanzania fall behind.

Despite efforts to activate a new IMF program, the arrangement has remained largely inactive for almost a year. The data underscores the government’s reliance on the Washington-based lender to manage fiscal gaps and sustain development projects.

Alternative Revenue Sources Targeted to Reduce IMF Loans

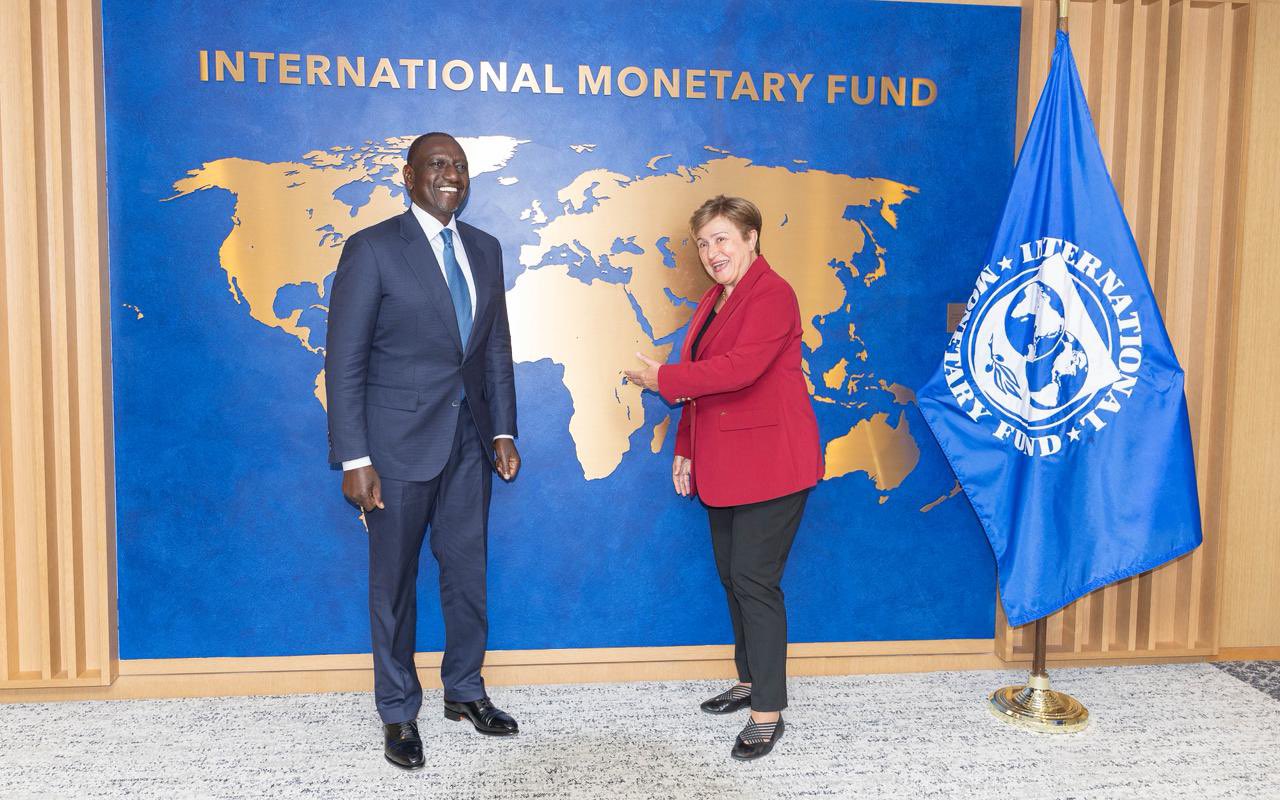

In a bid to reduce dependence on IMF loans, the Kenyan government has outlined plans to explore alternative revenue streams beyond direct taxation. President William Ruto announced intentions to securitize savings held by the National Social Security Fund NSSF, aiming to finance development without escalating foreign debt.

The strategy intends to progressively eliminate external borrowing for development within the next 10 to 20 years, signaling a shift toward leveraging domestic financial resources.

Currency Swaps and Debt Management

Kenya has also pursued debt management innovations, including shifting some repayments from US dollars to Chinese yuan. The move, exemplified by the recent Standard Gauge Railway SGR loan repayment, drew caution from the IMF. While currency swaps can reduce borrowing costs, the Fund warns they may introduce new risks.

IMF spokespersons emphasize that such strategies must align with medium-term debt and reserve management frameworks to balance cost savings with currency vulnerabilities.

Implications for Kenya’s Economic Stability

Kenya’s position among the top global borrowers raises questions about fiscal sustainability and economic resilience. Heavy reliance on IMF loans exposes the country to external shocks, exchange rate fluctuations, and conditionality pressures.

Treasury CS John Mbadi, PS Chris Kiptoo, and CBK Governor Kamau Thugge are actively engaging with the IMF and World Bank to negotiate terms that support economic reforms while managing repayment obligations.

The government’s push for securitization of domestic savings and alternative funding mechanisms reflects the urgency of reducing exposure to external lenders.

Kenya’s growing IMF debt demonstrates both the challenges of financing national development and the potential for strategic reforms to reduce dependency. While IMF Loans remain a critical financial lifeline, the government’s focus on domestic savings and innovative debt management will be key to sustaining long-term fiscal stability.